What is Return on Assets (ROA)?

Return on Assets (ROA) is a crucial financial ratio that measures how efficiently a bank or financial institution generates profit from its total assets. It helps investors and analysts evaluate how well a bank is utilizing its resources to create earnings.

A higher ROA indicates strong financial performance, while a lower ROA may signal inefficiencies or rising costs.

How is ROA Calculated?

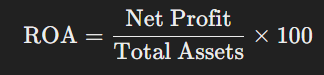

The formula for ROA is:

- Net Profit: The bank’s earnings after all expenses, including interest and taxes

- Total Assets: All financial resources, including loans, deposits, and investments

Why is ROA Important?

📌 Profitability Indicator

ROA shows how effectively a bank is converting assets into profits. A higher ROA means better efficiency.

📌 Risk & Performance Measurement

A declining ROA suggests higher costs, weaker earnings, or inefficient asset management, which could be a red flag for investors.

📌 Comparison Tool for Banks

Investors and analysts compare ROA across banks to assess which institutions generate better returns from their assets.

ROA Trends in Indian Banks

The ideal ROA varies based on the bank type and size:

✔ Public Sector Banks (PSBs): 0.5% – 1% (lower due to government regulations and high asset bases)

✔ Private Banks: 1% – 2% (better asset utilization and profitability)

✔ NBFCs & Small Finance Banks: 1.5%+ (higher returns due to specialized lending)

How Banks Improve ROA

To enhance ROA, banks can:

✔ Increase interest income by optimizing lending rates

✔ Reduce non-performing assets (NPAs) to avoid bad loans

✔ Improve cost efficiency by lowering operational expenses

✔ Focus on high-return investment opportunities

Final Thoughts

Return on Assets (ROA) is a vital metric that reflects a bank’s profitability and efficiency in using its assets. Higher ROA values indicate better performance, while lower ROA values may signal inefficiencies or rising costs.

For investors, tracking ROA trends can offer valuable insights into a bank’s financial health and growth potential.

💡 Want more financial insights? Follow us for expert banking analysis! 🚀