What is Capital Adequacy Ratio (CAR)?

The Capital Adequacy Ratio (CAR) is a critical financial metric that measures a bank’s capital relative to its risk-weighted assets. It indicates how well a bank can absorb potential losses and maintain stability during financial stress. Regulators use CAR to ensure that banks have sufficient capital to support their risk exposures.

A higher CAR means that a bank is better equipped to handle unexpected losses, which boosts confidence among investors, depositors, and regulators.

How is CAR Calculated?

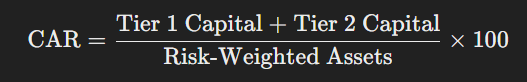

The CAR is calculated using the following formula:

Where:

- Tier 1 Capital: Core capital that includes common equity, disclosed reserves, and certain preferred stock.

- Tier 2 Capital: Supplementary capital that may include subordinated debt and hybrid instruments.

- Risk-Weighted Assets: Assets adjusted for their associated risk levels.

Why is CAR Important?

📌 Financial Stability & Safety

A robust CAR ensures that a bank has enough capital to withstand financial shocks, protecting depositors and the overall financial system.

📌 Regulatory Compliance

Regulatory bodies, such as the Reserve Bank of India (RBI) and the Basel Committee on Banking Supervision, set minimum CAR standards. Meeting these requirements is essential for a bank’s operation and credibility.

📌 Investor Confidence

A high CAR enhances investor trust, as it signals that the bank is well-capitalized and capable of managing risks effectively.

📌 Creditworthiness Indicator

Banks with a strong CAR are generally viewed as less risky, which can lead to better credit ratings and lower borrowing costs.

Example: Calculating the CAR

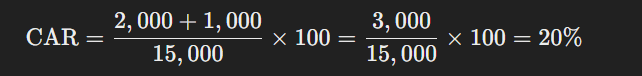

Imagine Bank ABC has the following data:

- Tier 1 Capital: ₹2,000 crores

- Tier 2 Capital: ₹1,000 crores

- Risk-Weighted Assets: ₹15,000 crores

Using the CAR formula:

This means Bank ABC has a Capital Adequacy Ratio of 20%, which is generally considered healthy by international standards.

CAR Trends in the Banking Industry

In the banking sector, maintaining an optimal CAR is essential for sustainable growth:

- Public Sector Banks (PSBs): Often face stricter regulatory scrutiny and may have slightly lower CARs due to legacy issues.

- Private Banks: Typically maintain higher CARs through effective risk management and capital planning.

- Global Standards: The Basel III framework recommends a minimum CAR of around 10.5% (including a capital conservation buffer), though many banks strive for higher ratios for added safety.

Final Thoughts

The Capital Adequacy Ratio (CAR) is a key indicator of a bank’s financial health and resilience. A higher CAR signifies strong capital management and a robust ability to manage risks, ensuring long-term stability. For investors and regulators alike, monitoring CAR is essential to assess a bank’s capacity to endure economic downturns and unexpected financial shocks.