What is Cost to Income Ratio?

The Cost to Income Ratio (CIR) is a crucial financial metric that measures a bank’s operational efficiency. It compares the bank’s operating expenses to its net income, helping investors assess how well a bank controls costs relative to its earnings.

A lower CIR indicates better efficiency, while a higher CIR suggests higher operational costs, reducing profitability.

How is Cost to Income Ratio Calculated?

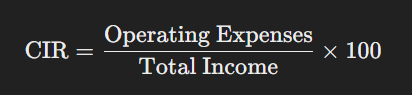

The formula for CIR is:

- Operating Expenses: Includes salaries, rent, IT costs, and administrative expenses

- Total Income: Includes interest income and non-interest income from banking activities

Why is CIR Important?

📌 Efficiency Indicator

A lower CIR means the bank is generating higher income relative to its expenses, signaling strong operational efficiency.

📌 Profitability Measure

Banks with lower CIRs have better cost control, leading to higher profitability and better shareholder returns.

📌 Investor & Analyst Benchmark

CIR helps compare banks to assess which institutions manage costs effectively while maintaining steady income growth.

CIR Trends in Indian Banks

Cost to Income Ratio varies across banking segments:

✔ Public Sector Banks (PSBs): 45% – 55% (higher costs due to extensive branch networks and government mandates)

✔ Private Banks: 35% – 45% (better efficiency due to digital banking and cost optimization)

✔ NBFCs & Small Finance Banks: 50%+ (higher due to niche lending and operational costs)

How Banks Improve Cost to Income Ratio

To reduce CIR and improve efficiency, banks can:

✔ Adopt digital banking solutions to lower operational costs

✔ Optimize branch networks and focus on online services

✔ Increase fee-based income from wealth management and advisory services

✔ Improve cost management through automation and AI-driven banking solutions

Final Thoughts

The Cost to Income Ratio (CIR) is a key indicator of a bank’s operational efficiency and profitability. Lower CIR values indicate strong cost control and better financial health, while higher CIR values suggest rising costs that may impact growth.

For investors and banking professionals, tracking CIR trends helps identify well-managed banks with strong growth potential.