What is Credit Growth?

Credit growth refers to the increase in the total amount of loans and advances provided by banks and financial institutions over a given period. It serves as a critical indicator of economic activity, reflecting how much banks are lending to businesses, consumers, and other sectors. Strong credit growth generally signals expanding economic opportunities and increased consumer spending.

How is Credit Growth Calculated?

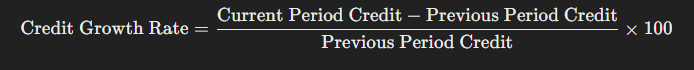

The credit growth rate can be calculated using the following formula

Where:

- Current Period Credit: The total loans and advances in the current period.

- Previous Period Credit: The total loans and advances in the previous period.

This formula helps measure the percentage increase in lending over time, making it easier to track trends and evaluate a bank’s performance.

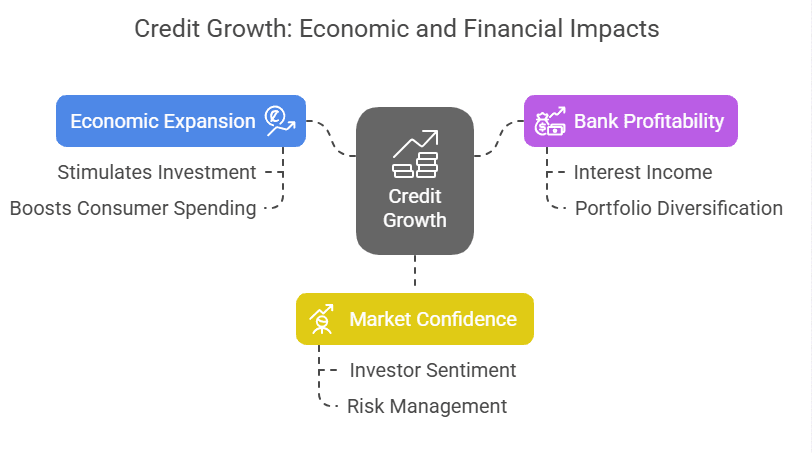

Why is Credit Growth Important?

📌 Economic Expansion

- Stimulates Investment: Increased credit availability encourages businesses to invest in expansion, such as upgrading technology or increasing production capacity.

- Boosts Consumer Spending: More loans to consumers often lead to higher spending, driving demand for goods and services and further stimulating the economy.

📌 Bank Profitability

- Higher Interest Income: More lending results in greater interest income for banks, contributing to improved profitability.

- Portfolio Diversification: A growing credit portfolio helps banks diversify their revenue streams and reduce reliance on a single market segment.

📌 Market Confidence

- Investor Sentiment: Healthy credit growth bolsters investor confidence by reflecting robust financial activity and an expanding economy.

- Risk Management: Monitoring credit growth trends assists banks and regulators in identifying potential risks, such as rising default rates or credit bubbles.

Key Drivers of Credit Growth

Several factors influence the pace of credit growth in the banking sector:

- Monetary Policy: Central bank interest rate decisions and regulatory guidelines can either stimulate or restrain lending.

- Economic Conditions: Overall economic growth, employment levels, and consumer confidence determine the demand for credit.

- Technological Advancements: Digital banking and online lending platforms streamline the loan approval process, increasing the ease of access to credit.

- Regulatory Environment: Government policies and regulatory frameworks play a significant role in shaping the credit landscape by imposing risk management and lending standards.

Example: How Credit Growth Impacts the Economy

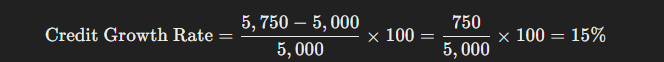

Imagine Bank ABC, a prominent private bank, experienced an increase in total loans from ₹5,000 crores last year to ₹5,750 crores this year. Using the credit growth formula

This 15% growth in credit indicates that Bank ABC is lending more actively, which can lead to:

- New Job Opportunities: Businesses expand and hire more staff.

- Increased Production: Enhanced lending supports operational expansion.

- Rising Consumer Demand: More personal loans boost consumer spending, driving further economic activity.

Credit Growth Trends in the Modern Banking Landscape

- Digital Transformation: The rise of fintech and digital lending platforms is accelerating credit growth by reaching underserved segments.

- Sector-Specific Trends: Credit growth in retail and consumer loans has been robust, while sectors like real estate may experience slower growth due to regulatory pressures.

- Global Influences: Shifts in global economic conditions, trade dynamics, and international capital flows can also impact domestic credit growth.

Final Thoughts

Credit growth is a vital metric for gauging economic health and bank performance. It indicates how effectively banks are expanding their lending portfolios, which in turn stimulates economic expansion, drives profitability, and boosts investor confidence. However, rapid credit expansion must be managed carefully to avoid risks like higher default rates or asset bubbles.

💡 Stay informed with our expert analysis to understand how credit growth can shape future economic opportunities and financial stability! 🚀