What is Deposit Growth?

Deposit growth refers to the increase in the total amount of deposits that customers place with banks over a specific period. It is a vital indicator of a bank’s liquidity, customer confidence, and overall financial health. A steady rise in deposits not only supports the bank’s lending activities but also enhances its ability to manage day-to-day operations and meet regulatory requirements.

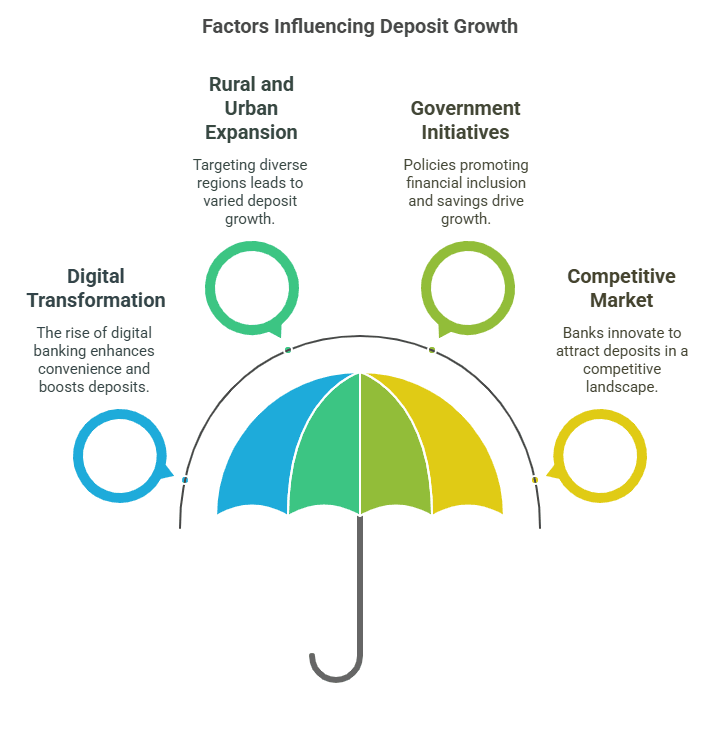

How is Deposit Growth Calculated?

The deposit growth rate can be calculated using the following formula: Deposit Growth Rate=

Where:

- Current Period Deposits: Total deposits received during the current period.

- Previous Period Deposits: Total deposits received in the previous period.

This formula provides the percentage increase in deposits over time, allowing banks and investors to assess the strength and sustainability of a bank’s funding base.

Why is Deposit Growth Important?

📌 Liquidity & Funding

- Stable Funding Base: Increased deposits provide banks with a reliable source of funds for lending and investment activities.

- Enhanced Liquidity: Higher deposits improve a bank’s liquidity position, ensuring it can meet withdrawal demands and regulatory requirements.

📌 Customer Confidence

- Trust in the Bank: Consistent deposit growth signals customer confidence and trust in the bank’s stability and services.

- Market Reputation: Robust deposit growth can enhance a bank’s reputation, attracting even more customers.

📌 Profitability & Growth

- Cost-Effective Funding: Deposits typically offer a lower cost of funds compared to other financing options, which can improve a bank’s net interest margin.

- Support for Expansion: A growing deposit base enables banks to expand their lending portfolio, driving further profitability and economic growth.

Example: Calculating Deposit Growth

Imagine Bank XYZ reported total deposits of ₹20,000 crores in the previous year and ₹22,000 crores in the current year. Using the deposit growth formula: Deposit Growth Rate=

This 10% growth indicates that Bank XYZ has successfully increased its customer deposits, strengthening its funding base and liquidity position.

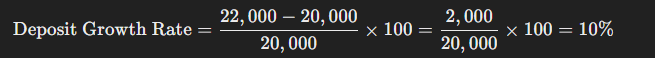

Key Drivers of Deposit Growth

Several factors contribute to deposit growth in the banking sector:

- Interest Rates: Competitive interest rates on savings and fixed deposits can attract more customers.

- Economic Conditions: A stable and growing economy increases disposable incomes, leading to higher savings and deposits.

- Digital Banking: Enhanced digital platforms and mobile banking apps make it easier for customers to open and manage deposit accounts.

- Customer Service: Quality service and trust in the bank’s brand can significantly drive deposit growth.

- Innovative Products: Offering a range of deposit products, such as recurring deposits and high-yield savings accounts, caters to diverse customer needs.

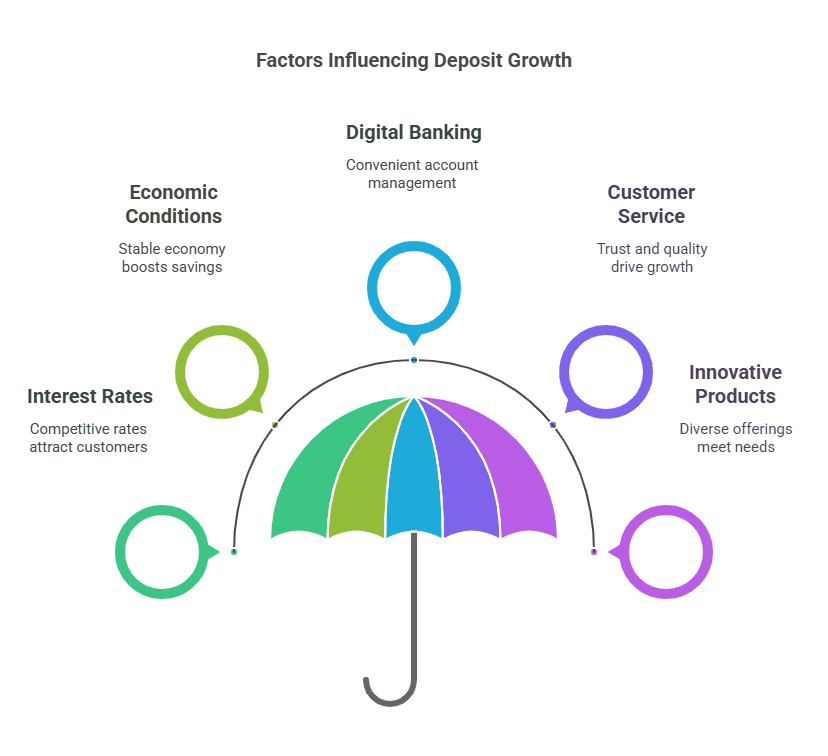

Deposit Growth Trends in the Modern Banking Landscape

- Digital Transformation: The surge in digital banking has made it convenient for customers to open accounts and manage funds, boosting deposit growth.

- Rural and Urban Expansion: Banks targeting both urban centers and rural areas can see varied deposit growth patterns, depending on regional economic dynamics.

- Government Initiatives: Policies aimed at increasing financial inclusion and incentivizing savings contribute to deposit growth.

- Competitive Market: As banks compete for customer deposits, they continuously innovate in product offerings and customer service.

Final Thoughts

Deposit growth is a critical metric that reflects the strength of a bank’s funding base, customer trust, and overall financial stability. A healthy increase in deposits not only supports the bank’s lending and investment operations but also reinforces its reputation in the market. For investors, banking professionals, and policymakers, tracking deposit growth trends offers valuable insights into the banking sector’s health and future growth potential.

💡 Stay tuned for more expert insights on banking metrics and financial trends to make informed decisions and understand the evolving financial landscape! 🚀