What is the GNPA Ratio?

The Gross Non-Performing Assets (GNPA) Ratio is a key indicator of a bank’s asset quality. It measures the percentage of loans and advances that have turned into non-performing assets (NPAs) relative to the total loans disbursed by the bank. A high GNPA ratio signals deteriorating asset quality, while a low ratio indicates better credit management and financial health.

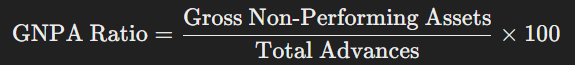

How is the GNPA Ratio Calculated?

The formula for calculating the GNPA Ratio is:

Where:

- Gross Non-Performing Assets: Loans where borrowers have defaulted or are in arrears beyond the prescribed period.

- Total Advances: The total amount of loans and advances provided by the bank.

Why is the GNPA Ratio Important?

📌 Indicator of Asset Quality

A lower GNPA ratio indicates that a bank has a smaller portion of its loan portfolio under stress, which is a sign of effective credit risk management.

📌 Impact on Profitability

Higher GNPA ratios can lead to increased provisions for bad loans, reducing a bank’s profitability. Investors often scrutinize this ratio to assess the health of a bank’s loan book.

📌 Risk Management Tool

Banks and regulators monitor the GNPA ratio to identify potential risks in the financial system. Consistently high or rising GNPA ratios may trigger corrective measures to mitigate future losses.

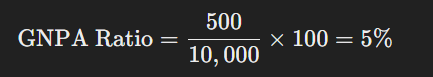

Example: Calculating the GNPA Ratio

Imagine Bank XYZ has:

- Total Advances: ₹10,000 crores

- Gross Non-Performing Assets: ₹500 crores

Using the GNPA Ratio formula:

This means that 5% of Bank XYZ’s total advances are non-performing assets. A 5% GNPA ratio would be a critical metric for investors and analysts, suggesting that while the bank is managing a significant volume of loans, there is still a portion that is not generating income.

GNPA Ratio Trends in Indian Banks

In India, the GNPA ratio can vary significantly between different types of banks:

- Public Sector Banks (PSBs): Often report higher GNPA ratios due to legacy issues and higher exposure to stressed sectors.

- Private Banks: Generally have lower GNPA ratios as they tend to have stricter credit policies and better risk management.

- NBFCs & Small Finance Banks: May show varied GNPA ratios based on their niche lending portfolios and risk appetite.

Final Thoughts

The Gross Non-Performing Assets (GNPA) Ratio is a critical measure of a bank’s credit health and overall asset quality. By understanding and monitoring the GNPA ratio, investors and banking professionals can gain valuable insights into a bank’s risk management practices and financial stability.

💡 Want more financial insights and detailed banking analysis? Stay tuned for expert commentary on key banking metrics and trends! 🚀