What is Liquidity Coverage Ratio (LCR)?

The Liquidity Coverage Ratio (LCR) is a crucial financial metric that ensures banks maintain an adequate level of high-quality liquid assets (HQLA) to cover short-term cash outflows in times of financial stress. Introduced under the Basel III framework, the LCR aims to strengthen banks’ liquidity positions and improve their ability to withstand economic downturns.

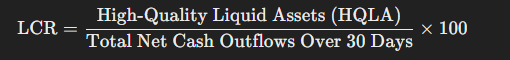

LCR Formula

The LCR is calculated using the following formula: LCR=

Where:

- High-Quality Liquid Assets (HQLA): Assets that can be quickly converted into cash with minimal loss in value, such as government bonds and central bank reserves.

- Total Net Cash Outflows: Expected cash outflows minus expected cash inflows over a 30-day stress period.

Banks must maintain an LCR of at least 100%, meaning their liquid assets should be enough to cover their projected cash outflows for 30 days during a crisis.

Why is LCR Important?

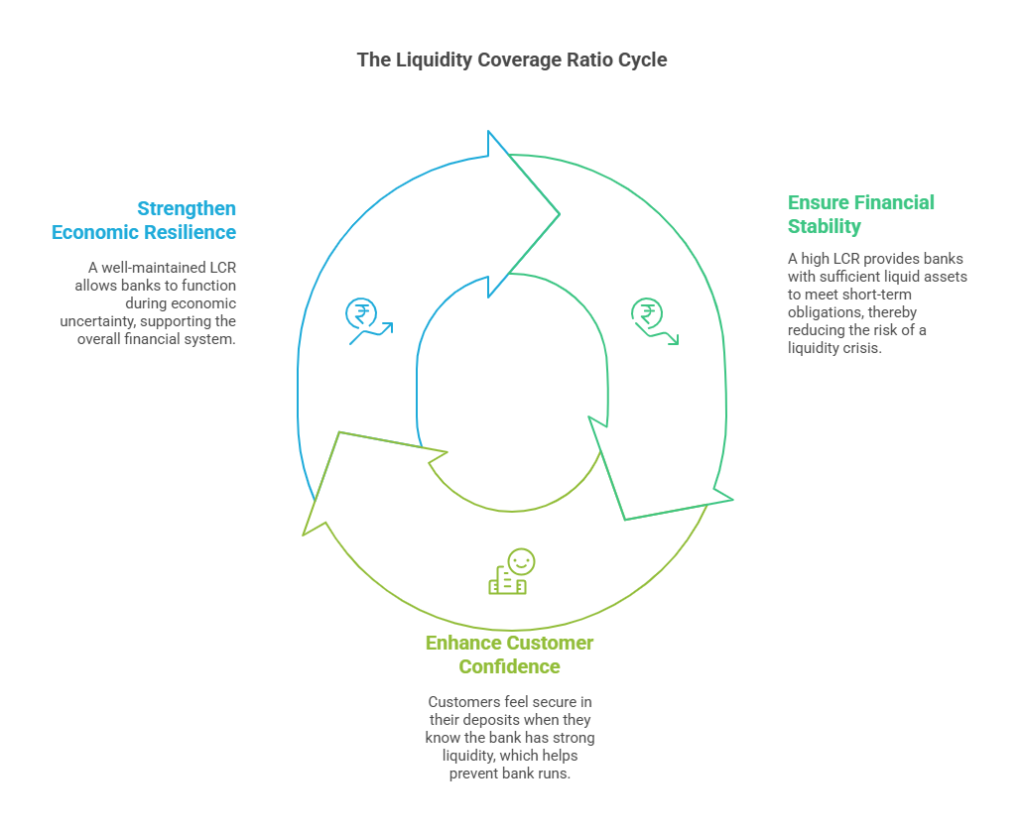

📌 Ensures Financial Stability

- A high LCR ensures banks have enough liquid assets to meet short-term obligations, reducing the risk of a liquidity crisis.

📌 Enhances Customer Confidence

- When customers know a bank has strong liquidity, they feel more secure in keeping their deposits, reducing the risk of bank runs.

📌 Strengthens Economic Resilience

- A well-maintained LCR ensures banks can continue functioning even in periods of economic uncertainty, supporting the overall financial system.

Example: LCR Calculation

Let’s say Bank ABC has:

- ₹10,000 crores in High-Quality Liquid Assets (HQLA)

- ₹8,000 crores in total net cash outflows over the next 30 days

Using the LCR formula:

Since Bank ABC’s LCR is above 100%, it has enough liquidity to meet its short-term obligations, ensuring financial stability.

Key Factors Affecting LCR

- Central Bank Policies: Regulations set by the Reserve Bank of India (RBI) and other central banks impact how banks maintain liquidity.

- Market Conditions: Economic downturns or financial crises may lead to increased withdrawals, affecting LCR.

- Bank’s Loan Portfolio: A higher proportion of illiquid loans can reduce HQLA, lowering LCR.

Final Thoughts

The Liquidity Coverage Ratio (LCR) is a key banking metric that ensures financial institutions remain liquid and stable even in economic stress. A healthy LCR protects customers, strengthens investor confidence, and ensures long-term financial resilience.

💡 Understanding LCR is essential for investors, banking professionals, and policymakers to evaluate a bank’s risk management and financial health! 🚀