What is the NNPA Ratio?

The Net Non-Performing Assets (NNPA) Ratio is a key metric used to assess a bank’s asset quality. Unlike the GNPA ratio, which measures the total non-performing assets, the NNPA ratio accounts for the bank’s provisioning against bad loans. This ratio gives investors a clearer picture of the bank’s actual credit losses and recovery potential.

A lower NNPA ratio indicates better asset quality and effective risk management, while a higher NNPA ratio suggests a larger portion of the bank’s loan portfolio is non-performing even after accounting for provisions.

How is the NNPA Ratio Calculated?

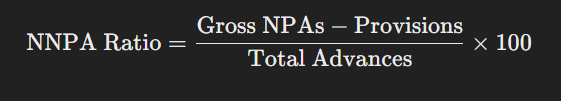

The formula for NNPA Ratio is:

- Gross NPAs: The total value of loans that are classified as non-performing.

- Provisions: The funds set aside by the bank to cover potential losses from non-performing loans.

- Total Advances: The overall loans and advances provided by the bank.

Why is the NNPA Ratio Important?

📌 Refined Asset Quality Indicator

By accounting for provisions, the NNPA ratio provides a more accurate reflection of the bank’s credit risk compared to the GNPA ratio.

📌 Impact on Profitability

A lower NNPA ratio means that the bank has effectively managed its non-performing assets, which can lead to lower credit losses and better profitability.

📌 Risk Management Insight

Investors and analysts monitor the NNPA ratio to understand a bank’s credit risk exposure and its ability to absorb losses from bad loans.

📌 Benchmarking Tool

The NNPA ratio is used to compare banks’ performance in managing bad loans and ensuring financial stability.

Example: Calculating the NNPA Ratio

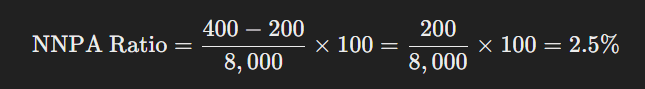

Imagine Bank ABC has the following data:

- Total Advances: ₹8,000 crores

- Gross NPAs: ₹400 crores

- Provisions: ₹200 crores

Using the NNPA formula:

This means that after accounting for provisions, 2.5% of Bank ABC’s advances are net non-performing assets. A 2.5% NNPA ratio is a critical indicator for investors, reflecting the bank’s effective handling of its bad loans.

NNPA Ratio Trends in Indian Banks

In India, the NNPA ratio varies by bank type:

- Public Sector Banks (PSBs): Typically exhibit a higher NNPA ratio due to legacy issues and exposure to stressed sectors.

- Private Banks: Often maintain a lower NNPA ratio due to robust risk management practices.

- NBFCs & Small Finance Banks: Their NNPA ratios can vary significantly based on the specific nature of their lending portfolios and provisioning policies.

Final Thoughts

The Net Non-Performing Assets (NNPA) Ratio is an essential metric for evaluating a bank’s true asset quality. By deducting provisions from gross NPAs, it provides a refined perspective on credit risk and the bank’s capacity to manage bad loans. For investors and banking professionals, tracking NNPA trends is vital for understanding financial health and making informed decisions.

💡 Stay tuned for more expert insights on banking metrics and financial analysis to make smarter investment decisions! 🚀