What is Return on Equity (ROE)?

Return on Equity (ROE) is a crucial financial ratio that measures how efficiently a bank generates profit from its shareholders’ equity. It helps investors assess how well a bank is using its capital to create value.

A higher ROE indicates strong financial performance and effective capital utilization, while a lower ROE may suggest inefficiencies or increased risks.

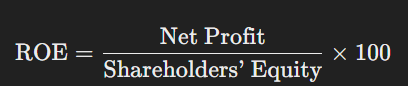

How is ROE Calculated?

The formula for ROE

- Net Profit: The bank’s earnings after all expenses, including interest and taxes

- Shareholders’ Equity: The total capital invested by shareholders, including retained earnings

Why is ROE Important?

📌 Profitability & Efficiency Indicator

ROE shows how effectively a bank utilizes shareholder funds to generate profits. A higher ROE means better returns for investors.

📌 Risk & Stability Measure

A declining ROE can signal higher costs, weak earnings, or inefficient capital management, which can impact investor confidence.

📌 Comparison Tool for Investors

Investors and analysts use ROE to compare different banks’ profitability and financial health.

ROE Trends in Indian Banks

ROE varies depending on the bank type and operational model:

✔ Public Sector Banks (PSBs): 8% – 12% (lower due to government mandates and higher risk exposure)

✔ Private Banks: 12% – 18% (higher due to better capital efficiency and profitability)

✔ NBFCs & Small Finance Banks: 15%+ (higher returns due to niche lending and risk-based pricing)

How Banks Improve ROE

To enhance ROE, banks can:

✔ Increase net profit by optimizing interest income and reducing costs

✔ Manage risk efficiently by controlling non-performing assets (NPAs)

✔ Optimize capital structure to maintain a balance between debt and equity

✔ Expand high-margin lending and fee-based services

Final Thoughts

Return on Equity (ROE) is a vital metric for assessing a bank’s profitability and efficiency in utilizing shareholder capital. Higher ROE values indicate strong financial performance, while lower ROE values may signal inefficiencies or rising risks.

For investors, tracking ROE trends can provide valuable insights into a bank’s growth potential and financial stability.

💡 Want more financial insights? Follow us for expert banking analysis! 🚀